Winning the banking switch with behavioural rewards

Sponsored by ValuedynamxAs savvy UK consumers increasingly switch banks, providers should rethink loyalty through personalised, brand-based behavioural rewards that create lasting value

For years, UK banks have counted on banking inertia – when customers stick with their bank or credit card simply out of habit or convenience. And to some extent, that has worked: over a third of UK consumers have held the same bank account for more than 20 years. But that kind of passive loyalty is no longer guaranteed, with more banking options available than ever and attractive incentives to switch, drawing more customers away.

Changing banks is becoming more accessible, with programmes such as the UK’s seven day switching service streamlining what was once a complex process. In 2024 alone, more than a million people switched banks, driven by the search for better digital features, stronger incentives and more meaningful value. With many UK providers paying as much as £300 to switchers, it’s no wonder more and more people are making the leap.

Younger customers are especially open to switching, signalling a generational shift in expectations of banking relationships. Add to that a rising appetite for digital-first banking and fintech challengers, and the message is clear: inertia is no longer a customer loyalty safety net.

To remain competitive, banks need to evolve from hoping customers will stay to giving them obvious reasons to choose – and continue using – their financial products. One way to do that? Modernising loyalty programmes through behavioural rewards and incentives that are both personalised and based on relevant merchants and brands. These programmes don’t just reduce churn; they deepen engagement and help differentiate the brand to and attract new customers.

Behavioural rewards: an acquisition and retention engine

Behavioural rewards are one of the most effective ways for banks to modernise their loyalty strategy to win new customers and deepen relationships with existing ones. These programmes incentivise customers to take certain actions – from switching accounts to using a new card, setting up direct deposit, enabling alerts, or simply logging into the app.

The rewards can range in scope, from cash on sign-up to cashback on everyday purchases, tiered incentives that grow with usage, or even high-value rewards such as premium electronics or travel vouchers for major commitments such as opening an account or making a significant deposit. Over time, they help turn simple actions into lasting habits, gradually integrating the account into a cardholder’s financial routine.

Behavioural rewards build a much deeper form of engagement than simply dangling a cash-based carrot at sign-up and then going quiet. Those one-time offer campaigns may generate some quick wins, but without providing ongoing value to customers, many of those new accounts may go inactive or disappear altogether when a better offer comes along. There’s also a cost consideration when comparing cash-based incentives with brand or merchant rewards, who may offer volume-based discounts.

With a behavioural rewards strategy, banks can build momentum and encourage sustained engagement. These programmes should be dynamic, adapting based on customer behaviour and evolving preferences to ensure they remain relevant over time. Rather than static incentives that quickly lose their appeal, successful programmes continuously adjust their rewards, personalisation and communication to match changing customer needs.

And for potential switchers, they offer something a one-time bonus can’t – a path to long-term value that grows and evolves with them. Instead of a single reason to switch, they create multiple reasons to stay, transforming simple banking transactions into ongoing lifestyle enhancement and cementing loyalty in ways traditional incentives cannot match.

Why personalised rewards are no longer optional

Personalisation is now table stakes for any modern bank loyalty strategy, and a must-have for behavioural rewards. In fact, nearly one third of credit card holders now say personalised rewards are a “need-to-have” feature in their card programmes. The biggest trap banks can fall into is assuming that one-size-fits-all rewards will work. Today’s customers expect rewards and incentives that reflect their unique spending habits, preferences and daily routines.

Based on customer data and behavioural insights, effective personalisation should deliver lifestyle-aligned rewards. This means airline miles for travellers, brand rewards that reflect a customer’s preferred brands, restaurant cashback for foodies, wellness discounts for fitness enthusiasts, or offers geo-targeted to where customers most often spend.

The most successful programmes understand that rewards aren’t just about transactions. They’re about transformation, enhancing lifestyles in ways that feel hand-picked, immediate and relevant. When rewards mirror real-world behaviour and adapt based on customer actions, they become more valuable and drive higher engagement.

The opportunity for banks? They already have the data. With customer consent, they can tap into existing transaction and behavioural insights to create dynamic rewards that can be personalised and tiered in real time. This approach puts customers in control of their data while delivering highly relevant experiences that evolve with changing preferences. Whether trying to win over new customers or re-engage longtime account holders, this level of personalisation builds trust and relevance, strengthens relationships and delivers genuine value to customers.

Merchant and brand-backed rewards sweeten the deal

Access to a robust network of merchant and brand partners is essential for banks to deliver effective behavioural rewards that truly resonate with their customers. Through these partnerships, banks can offer brand-specific deals on everyday purchases, such as cashback at their favourite retailers, without covering the full cost themselves. With this model, the merchant covers some of the costs in exchange for the bank’s marketing reach.

This partnership creates a mutually beneficial ecosystem where banks gain access to diverse reward options while merchants reach new audiences. Bank loyalty programmes offer retailers immediate access to vast, established customer bases, while banks benefit from enhanced programme value and reduced reward costs. For banks, these networks enable more compelling offers that drive customer engagement and retention. Meanwhile, merchants gain targeted marketing opportunities to reach millions of active consumers eager to gain rewards.

Banks have the unique ability to leverage this merchant network effectively since they already have access to such rich customer data, which they can use to offer deals from brands they know their customers prefer. Then they can proactively notify cardholders when offers are available, based on factors such as their spending habits, brand preferences, or even their location.

These merchant rewards help banks position themselves as everyday savings enablers, fostering customer loyalty beyond their traditional financial services while creating the personalised experiences that make behavioural rewards programmes successful.

Winning the switch – and keeping customers engaged

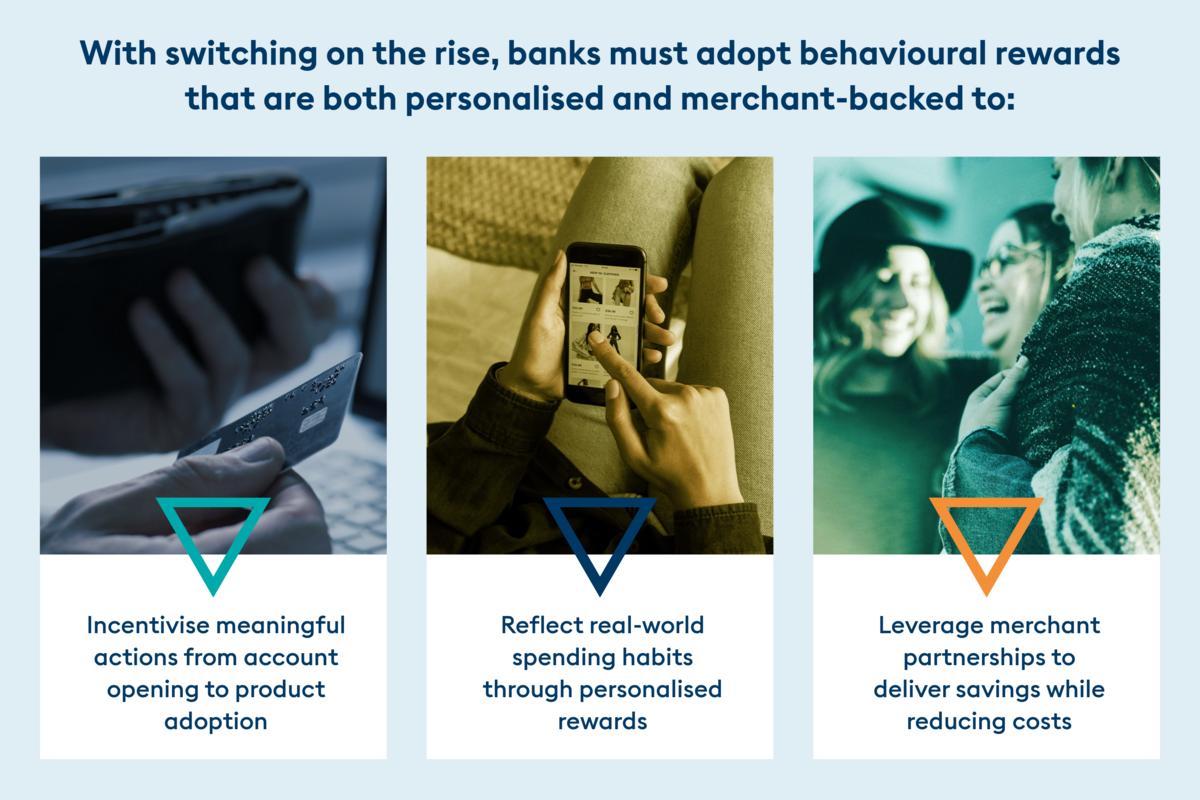

Banks can no longer rely on “set it and forget it” loyalty strategies. With switching on the rise, banks must adopt behavioural rewards that are both personalised and merchant-backed to:

- Incentivise meaningful actions from account opening to product adoption

- Reflect real-world spending habits through personalised rewards

- Leverage merchant partnerships to deliver savings while reducing costs

These elements give customers multiple reasons to choose a bank and stay. In today’s market, loyalty must be re-earned daily.

Learn how leading banks are using behavioural rewards to drive customer actions and reduce churn at Valudynamx.com.

Mark Jackson is Managing Director of Collinson Valuedynamx, which delivers data-driven commerce rewards that help financial institutions and loyalty companies boost customer engagement and create competitive advantage.

Business Reporter Team

You may also like

Related Articles

Most Viewed

Winston House, 3rd Floor, Units 306-309, 2-4 Dollis Park, London, N3 1HF

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2025, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543