Transforming payments technology with AI

Sponsored by StripeGlobal payments processor Stripe explores how artificial intelligence is revolutionising business payments by boosting revenue, reducing fraud and transforming customer experience

Artificial intelligence (AI) in payments technology is now an essential operational tool for solving some of the most costly and complex problems in the business payment lifecycle. Organisations that fail to take advantage of it are leaving significant revenues on the table, as well as failing to optimise their financial security.

AI is also quietly reshaping the way money moves: how transactions are approved, how fraud is detected and how disputes are managed. What once required teams of highly paid analysts and lengthy lists of rigid rules can now be handled by intelligent systems that learn, predict and optimise in real time.

For businesses, especially those operating across borders, this transformation offers something rare: the chance to increase revenue, reduce costs, address fraud and improve customer experience all at the same time.

The problems with payments

Most business leaders are acutely aware that unnecessary friction at the checkout drives many users to abandon their shopping carts. What’s less well known is just how many other invisible costs from fraud and failed authorisations are lurking in the payment process.

Payment fraud is one of the most significant financial risks in digital commerce. Beyond direct financial losses for lost goods, businesses face substantial chargeback fees of approximately $55 billion annually, in addition to the administrative burden of managing disputes.

The challenge is that fraudsters are adaptive. Static, rules-based fraud systems create a constant cat-and-mouse game. Retailers update a rule to catch one scam, and another slips through elsewhere. Worse still, overly aggressive filters often block legitimate transactions, leading to “false positives” that alienate genuine customers and damage lifetime value.

Another pain point is failed payments. This is a revenue killer that many businesses fail to address, often because they simply don’t notice it. But it is highly significant: unnecessary declines are projected to reach $265 billion by 2027, costing both immediate revenue and long-term customer relationships.

The reasons for payment failures are varied and can include customers simply mistyping their details. With AI-powered systems, authentication decisions can be based on real transaction risk rather than a one-size-fits-all approach. By analysing factors such as customer behaviour, device information and transaction details, AI can determine which payments require additional verification and which can safely proceed immediately.

Solving payment problems with AI

According to a recent guide to payments from Stripe, AI brings a new level of intelligence and adaptability to payments – not just by spotting patterns in data but acting on them in real time to optimise each transaction.

As well as addressing fraud and payment failures, AI can analyse the unique context of each checkout session: who the customer is, the device they are using, their purchase history and what they’re buying. Using these signals, AI can be used to optimise the checkout flow by avoiding unnecessary choices (offering an inappropriate payment method can reduce conversion rates significantly), maintaining persuasive messages and achieving the best balance between security and customer convenience.

This level of personalisation has been shown to significantly reduce drop-offs. Stripe has trained its payment systems on hundreds of billions of dollars in transactions around the world, meaning that it can fine-tune payment experiences for each customer segment and geography while still protecting merchant and customer privacy.

Another problem that AI can address is the cost of chargebacks. As online shopping has grown, chargebacks have also grown, and increasingly, many of these chargebacks are unjustified or even fraudulent. AI can help retailers determine whether a chargeback is justified; for example, a purchaser may simply need reminding of why a debit has been incurred. But AI can also flip dispute management from a reactive process into a proactive one by identifying risky charges before they become disputes and allowing businesses to intervene early, for example, by issuing refunds for known faulty goods or flagging suspicious behaviour.

AI agents and the future of e-commerce

While AI is already transforming today’s payment systems, the next wave of change will come from AI agents, autonomous systems capable of making purchasing decisions on behalf of users.

Imagine a world where your customer isn’t a person clicking the Buy Now button, but an AI assistant reordering supplies, booking services or managing subscriptions on behalf of their operator. These transactions will need to be machine-readable, fraud-resistant and instantly verifiable. When this happens, businesses will need checkout and authentication processes that are optimised for both human customers and AI agents. Preparing for this agentic commerce model will result in more cost-efficient payment systems, as well as happier, more loyal customers.

Preparing for the AI payments era

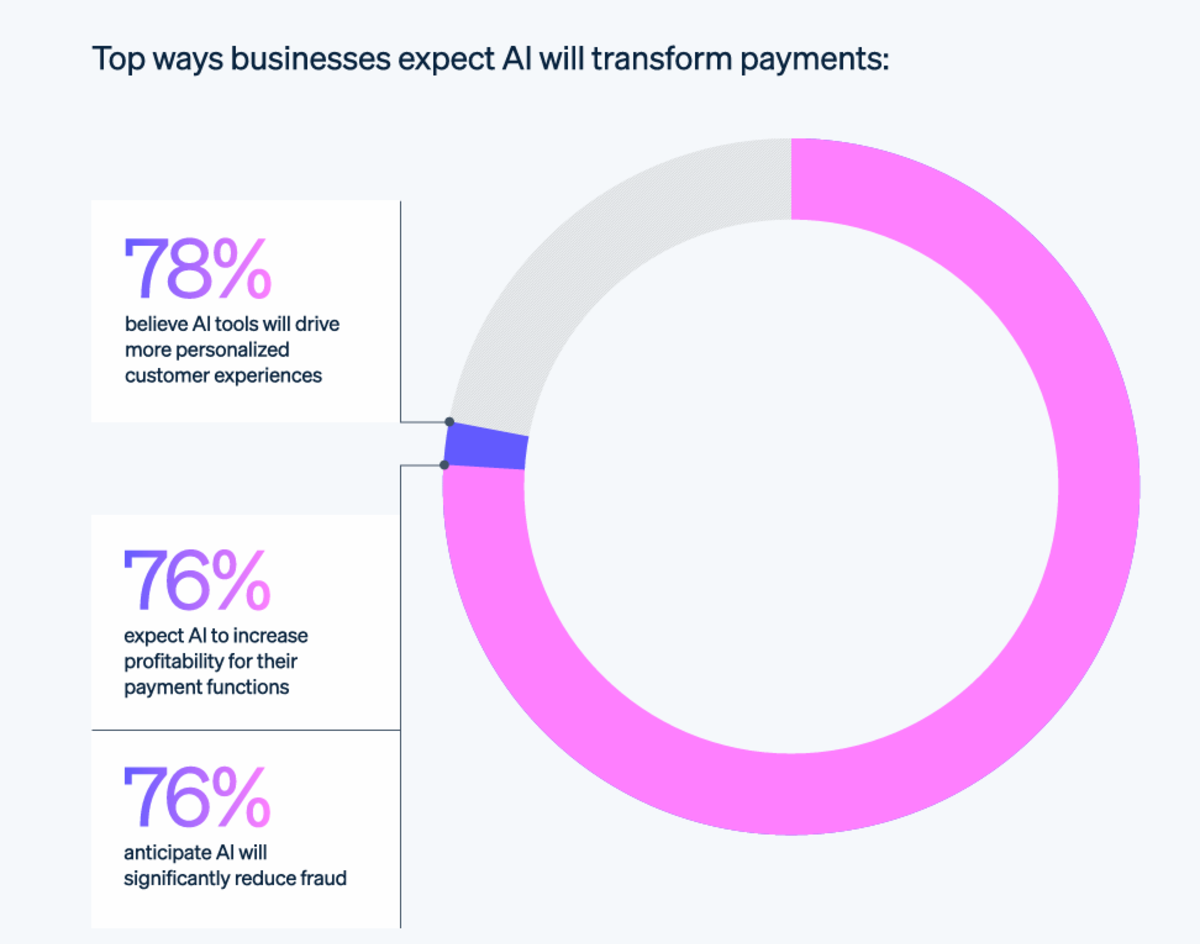

The use of AI in payment processes will drive up revenue through higher conversion rates and fewer failed transactions. It will also drive down costs with reduced losses from fraud and less time spent managing disputes.

To get started, organisations should:

- Audit payment performance: identify where authorisation rates drop, where fraud spikes and where disputes consume resources

- Integrate adaptive intelligence: use AI models that continuously learn from global data patterns

- Balance automation with oversight: automate risk decisions while maintaining human oversight and robust governance frameworks

- Prepare for AI agents: design payment systems that are ready for both human and machine buyers

The opportunity is clear: better payment performance, stronger customer trust and a more intelligent digital commerce ecosystem. Businesses that embed intelligence into their payment infrastructure can turn what was once a cost centre into a competitive advantage.

To explore how AI is reshaping payments, and how businesses can capitalise on the opportunity, read the full Stripe report: How AI is Transforming Payments

Business Reporter Team

You may also like

Most Viewed

Winston House, 3rd Floor, Units 306-309, 2-4 Dollis Park, London, N3 1HF

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2025, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543