TomTom lifts floor of 2025 guidance as automotive sales drive Q2 beat

(Reuters) - Dutch digital mapping specialist TomTom lifted the bottom end of its 2025 revenue guidance on Tuesday, after a better than expected performance in its core automotive business helped it beat market estimates in the second quarter.

The location data pioneer, which started by providing a navigational tool for turn-by-turn directions, has gone through major restructuring and is now developing high-definition self-driving maps that integrate consumer data and advanced driver assistance systems.

The Amsterdam-based company expects its revenue to come between 535 million and 565 million euros ($624.72 million and $659.75 million) this year, compared with the previous forecast of 505-565 million euros.

TomTom’s revenue fell 4% to 146.2 million euros in the second quarter, but beat the 145 million euros analysts had expected in a company-provided consensus, aided by a smaller than expected drop in the automotive location technology business.

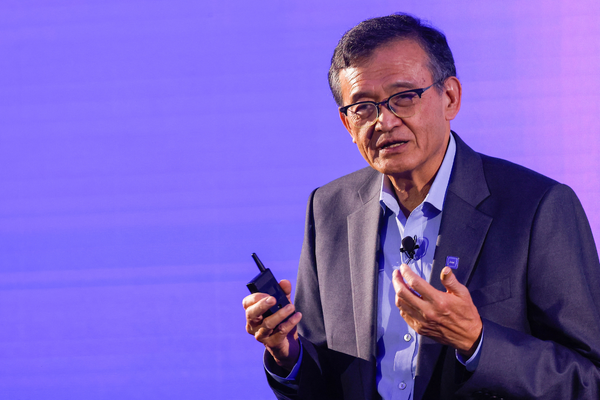

CEO Harold Goddijn said in a statement the automotive business continued to battle industry uncertainties in the quarter, while underlying growth in location tech for enterprises was more than offset by unfavourable exchange rate movements.

"We remain confident about our market position," he added, however. "In the second quarter, our maps were selected to support complex field service operations, optimize logistics, improve infrastructure investments, and more."

The group expects its location technology revenue, which includes the automotive and enterprise businesses, to be in a 465-490 million euro range in 2025, versus an earlier forecast of 440-490 million euros.

It sees a free cash flow at around 5% of the group revenue, after previously guiding it at break-even.

($1 = 0.8564 euros)

(Reporting by Mathias de Rozario in Gdansk, editing by Milla Nissi-Prussak)

Business Reporter Team

You may also like

Related Articles

Most Viewed

Winston House, 3rd Floor, Units 306-309, 2-4 Dollis Park, London, N3 1HF

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2025, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543