This insurtech SPAC successfully met its investors’ expectations

An insurtech’s five-year journey, from inception to acquisition by Poste Vita (Poste Italiane Group), delivered...

A five-year journey from the idea to create “a new independent carrier for non-life non-motor bancassurance” in the Italian market to the resultant company’s acquisition by Poste Italiane has been the result of a methodical blueprint, impeccably executed stages and continual adaptations throughout the ride.

The establishment of Archimede SPAC, raising €48 million in 2018, stands as an exemplar of an effective capital-sourcing strategy. It facilitated the acquisition of an appropriate sum from institutional investors while instituting a governance framework characteristic of a public company. The SPAC was presented to the market with an identified target and an industrial approach focused on governing the business combination. The venture was designed from scratch as contestable, having identified potential change of control as a source of value since the very beginning.

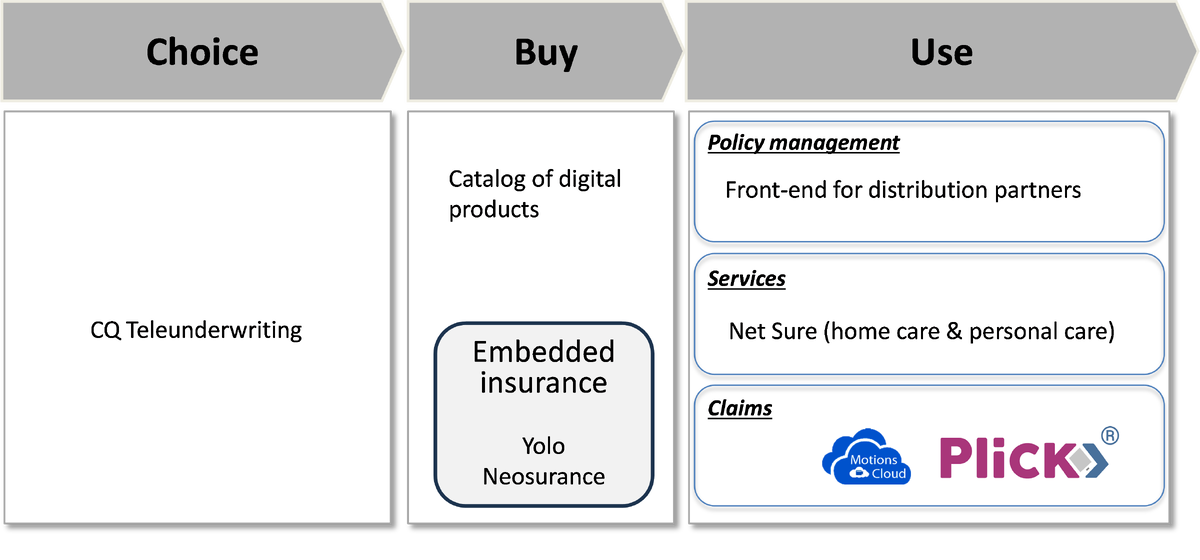

The creation of the multi-specialist/multi-pillar strategy was the business side of the coin and the rationale for the deal at its core. Finance was there to serve business, not the opposite. Since 2019, the characterisation of every segment chosen and developed over these are:

- Demonstrating a trajectory of sustained growth (for example, bancassurance within the P&C non-auto sector)

- Exhibiting profitability levels in line with market averages

- Possessing untapped potential for enhancement, encompassing both growth and profitability, through the application of specialised capabilities and technology

The role of the board, comprising seasoned professionals boasting substantial and diverse skillsets, in supporting and overseeing the execution of the strategy was designed as pivotal and confirmed in the practice.

The amalgamation of these elements has endowed Net Insurance with a distinctive corporate profile and a very scarce target. So, the end with Poste Italiane’s acquisition was the perfect realization of the original strategy. The synergies engendered by the new shareholder do not compromise the company’s focus and specialisation; rather, they bolster it by affording robust, vertically aligned attention and capabilities across every segment.

Consistent focus has been one of the key characteristics of Net Insurance’s journey since 2019. Coherently with the original Archimede plan, the management has worked on:

- Strengthening Net Insurance’s longstanding presence in insuring the CQ business, growing this business from €47 million to €102 million in 2022

- Cultivating a growth engine grounded in an extensive portfolio of insurance protection products, excluding auto insurance, distributed through bancassurance commercial agreements, brokers and digital partners.

The incorporation of technology and data integral to the original Archimede vision – the “insurtech inside” strategic model – has constituted a fundamental component in implementing this approach, combining both the turnaround of the traditional business and start-up of the new product lines.

The management team at Net Insurance has delivered exceptional results between 2019 and 2022, even surpassing the original targets, despite a challenging landscape marked by Covid-19, War and inflation/rates shock. During this period, it:

- Tripled the top-line revenue from €62 million in 2018 to €184 million, with the new business lines accounting for more than half of the total premiums

- Elevated the normalised profit from €4 million to €14 million, with an anticipated trajectory of reaching €25 million by the close of 2025

- Maintained a stable solvency ratio in the range of 170-180 per cent throughout the journey, surging to 200 per cent at the outset of 2023

The CQ business has benefited from technical excellence and process optimisation which, for the most recent generations, predicts a final loss ratio of 60 per cent, meaning excellent overall profitability and substaintially increased market share. Under the guidance of the new management, Net Insurance has further solidified its leadership position in this segment by harnessing the practical application of the company’s longstanding underwriting data and tapping into the organisation’s robust technical capabilities.

The blend of human relationships and technological assets have played a pivotal role, even in the inception of our bancassurance venture. Our collaboration and subsequent strategic investment in MotionsCloud empowered us to deliver a distinctive claims experience. This attribute, coupled with Net’s specialization and its unwavering commitment to bolstering the success of banks in P&C distribution, proved instrumental in being selected as the insurance provider by over 18 Italian banks, despite being the latecomer to the sector. The rapid establishment and subsequent expansion of these partnerships yielded €41 million in premiums by 2022, positioning the company as a central player in the growth of bancassurance channel, which rose from 9.9 per cent to 12.4 per cent of non-auto P&C premiums over the past four years.

Collaborations with digital brokers have enabled the development of an extensive array of digital capabilities and the exploration of various embedded insurance initiatives in conjunction with distribution partners such as EnelX, and Windtre, among others.

These business achievements have driven a strong value creation process. The value of the stock went from €4.69 per share to around €7.5 before the OPA – when compared with the competition, this was indisputable overperformance. The value recognised by Poste Italiane to Net allowed more than 21 per cent annual IRR to Archimede SPAC investors. Archimede stands out today as one of Italy’s most successful SPACs, boasting impressive overall shareholder returns amid the global insurtech SPAC landscape.

SPAC works if there is a strong business idea and correlated industrial project, not when the tool serves purely as a financial exercise.

This business history exemplifies again the effectiveness of innovation in creating economic value when steered by a strong foundation of insurance expertise, and one fully devoted to serving an identifiable, robust and distinctive business strategy.

By Andrea Battista, CEO Net Insurance, and Matteo Carbone, founder of the IoT Insurance Observatory and Chairman of the Net Insurance’s Innovation Advisory Board

Business Reporter Team

Most Viewed

23-29 Hendon Lane, London, N3 1RT

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2024, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543