Fighting payment fraud with AI

Global payments processor Stripe outlines the growing damage caused by payment fraud and explains how AI-driven tools are helping businesses combat these threats while unlocking new opportunities for growth

For business leaders, payment fraud is not just a nuisance: it’s a strategic risk. Traditional defences are being stretched by criminals who are using generative artificial intelligence (gen AI) to scale their attacks.

Yet AI is also rapidly becoming one of the most powerful tools in the fight against fraud. What was once a niche technology is now critical for protecting revenues, improving customer experience and preserving trust.

The state of payment fraud

A recent report by global payments processing platform Stripe, 2025 State of AI and Fraud, paints a stark picture. Fraudsters are no longer working in opportunistic ways: they are acting with industrial efficiency. They use gen AI to create fake identities and build entirely artificial websites, constructing highly convincing fronts to solicit payments. According to Stripe, one in three business leaders say that AI is making fake account creation and merchant fraud worse.

Meanwhile, more conventional fraud methods, such as brute-force attacks and credential stuffing, continue, but are now being automated and scaled. This “card-not-present” fraud is amplified by machine-speed attacks, which legacy systems were never built to counter. The consequences go beyond the immediate financial hit. Fraud also inflicts second-order damage: chargebacks, operational costs associated with manual reviews, reputational risk and, perhaps most insidious of all, false declines.

False declines add extra damage

In response to heightened fraud risk, many businesses have understandably ratcheted up their security processes. Often, they will rely on rules-based systems to weed out fraudulent payments: “if AVS fails, decline”; “if CVC mismatch, block”; and so on. This approach may stem the flow of fraud, but it does so at a cost. Rules-based systems tend to err on the side of caution because of their rigid logic: with static rules, there is no nuance, no real-time adaptability to fraudsters’ evolving tactics.

The result, in many cases, is a rise in false positives, with legitimate transactions being flagged and declined. These false declines don’t make headlines in the way major cyber-attacks do. But they can inflict even greater long-term damage. When genuine, honest customers are blocked, that’s not only lost revenue but also a very negative experience that can destroy loyalty and drive customers elsewhere.

Why traditional fraud prevention is failing

Traditional fraud solutions, such as rule engines and blacklists, worked well in a slower, less adversarial world. But fraud operations today, especially those powered by AI, pose a particular challenge to rule-based defences. Rules engines cannot easily detect sophisticated fake identities created by gen AI, nor can they dynamically adapt when fraudsters change strategy.

With fraud evolving so rapidly, static processes cannot keep pace with constantly changing patterns of abuse. And manual review teams are overwhelmed: the velocity and volume of modern e-commerce make the manual checking of digital payments costly, slow and prone to error.

The AI-powered solution

AI offers a fundamentally different way of operating by using machine learning (ML) to evaluate thousands of transactions in real time. The data captured includes standard transaction metadata, such as product, time, location, device type and IP address. In addition, behavioural data such as account history and purchase patterns are analysed to provide deeper insights. The analysis is further strengthened by intelligence gathered across the global payment ecosystem.

Machine learning models detect subtle anomalies and emerging fraud patterns. They can flag sudden shifts in behaviour, for instance, a surge in new account registrations from the same IP, or unusual transaction sizes, and then dynamically apply risk scoring. Importantly, they operate at machine speed, delivering real-time decisions that are far more granular and accurate than those of rule-based systems.

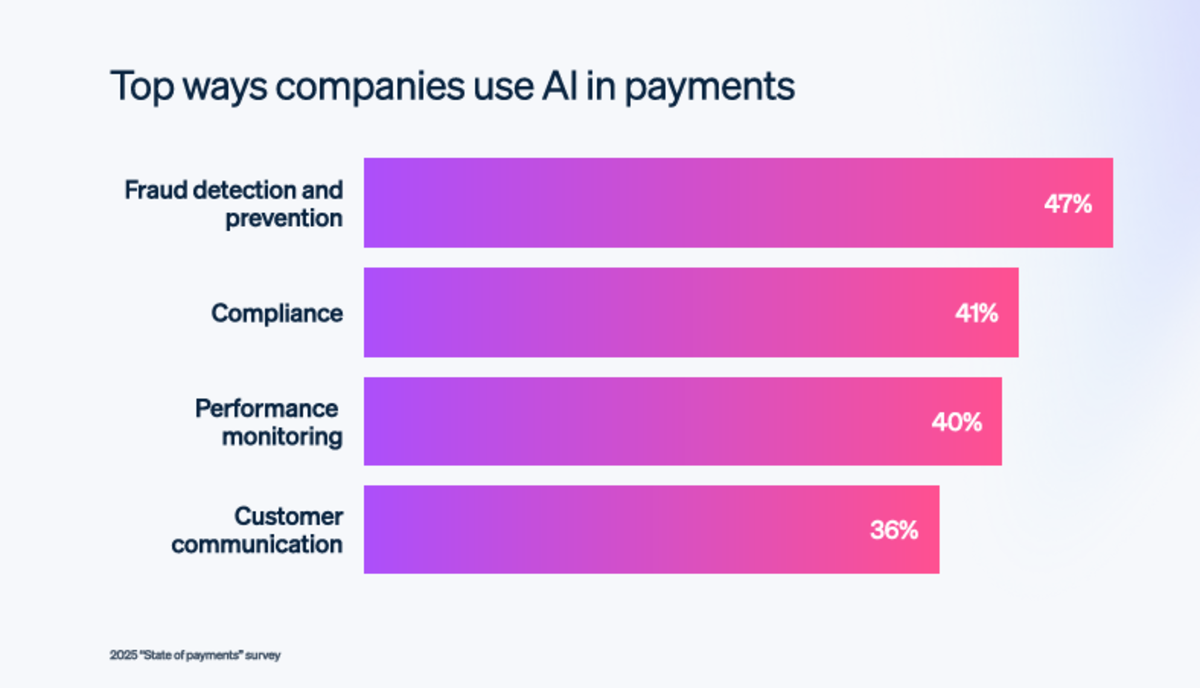

This approach works. Nearly half of all businesses now use AI tools or features in their fraud-prevention strategies.

The Stripe difference

Stripe provides a fully integrated suite of financial products that power payments for online and offline retailers, subscription businesses and marketplaces. At the centre of these products are AI-powered services designed to detect and combat fraud. Stripe processes payments for millions of companies, and its AI models benefit from very large volumes of data, enabling highly accurate risk assessments. This results in more fraud being detected and fewer genuine customers being declined. And because they learn continuously, Stripe’s AI models adapt to new fraud strategies, fast.

The business impact is threefold. First, higher authorisation of legitimate transactions increases revenue and enhances customer experience. Second, more accurate fraud blocking reduces chargebacks and fraud-related losses. Third, operational costs decline: fraud teams can focus on anomalies and exceptions, rather than wading through high volumes of manual reviews.

Building strategic advantage

Fraud prevention can no longer be treated as a purely defensive necessity. With AI-powered models, it becomes a strategic enabler. Smooth checkout experiences, fewer false declines and dynamic risk scoring all contribute to a trusted and scalable payment environment that supports growth.

In today’s e-commerce landscape, fraud is rising fast. But by deploying AI, businesses can turn that tide. Rather than react, you can pre-empt. Rather than protect, you can optimise. Effective fraud prevention becomes a catalyst for conversion, customer satisfaction and long-term resilience.

Investing in AI-powered fraud defences is no longer optional. It is a critical lever for enabling growth, safeguarding revenue and building trust in a world where the cost of false declines is very real and the fraud threat ever more sophisticated.

To learn more about preventing payment fraud, download the 2025 State of AI and Fraud report from Stripe

Business Reporter Team

You may also like

Most Viewed

Winston House, 3rd Floor, Units 306-309, 2-4 Dollis Park, London, N3 1HF

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2025, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543